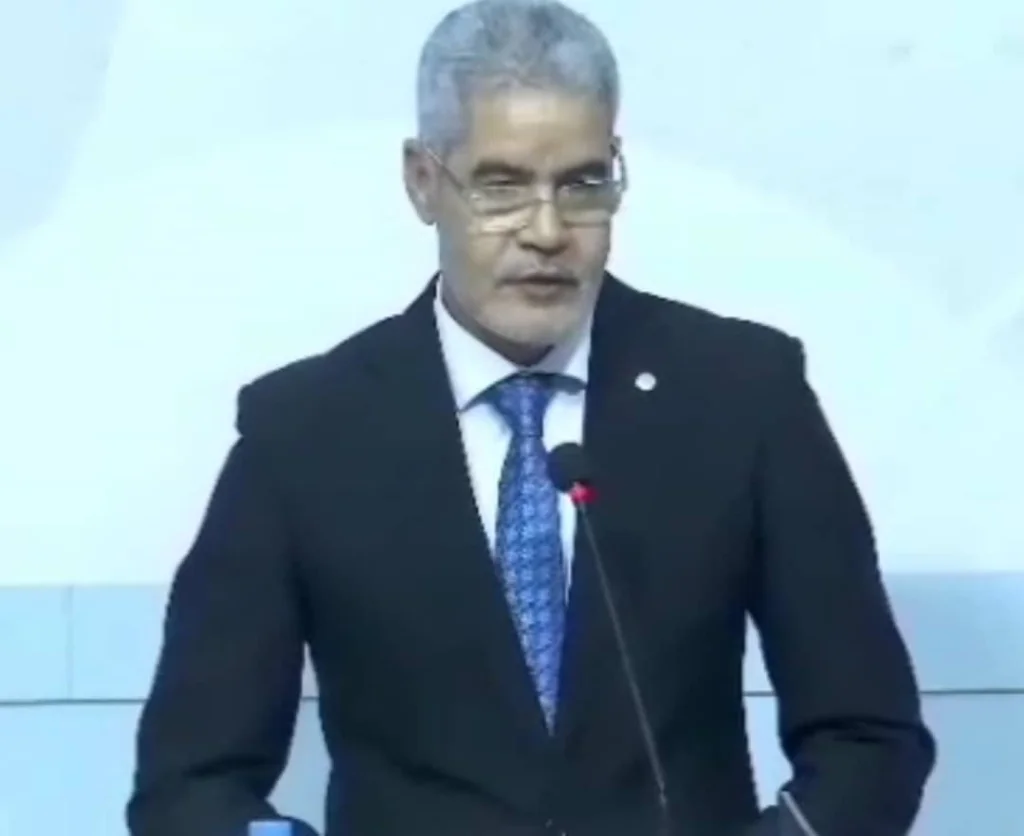

His Excellency the Minister of Economy and Finance responded to a question about large transfers via digital payment methods

In response to a question during the weekly press briefing about the impact of large cash transfers via digital payment methods on the national economy, Minister of Economy and Finance, Mr. Ahmed Ould Abah, clarified that such transactions, among other reasons, prompted the Central Bank to work on regulating them several months ago.

The Minister explained that while digital payment methods via mobile phones are used globally, they are intended for handling small transactions. Banks are specialized in conducting large transactions.

He noted that these methods are akin to a wallet for paying bills and delivery services, but it is unreasonable to use them for purchasing land or transferring large sums of money, as this could have adverse effects on the economy. Additionally, it might cast doubts on the transparency of the funds involved in these transfers and raise legal issues regarding the source of the money. Carrying large amounts of money in a digital wallet can be suspicious.

The Minister emphasized that the use of digital payment methods should be beneficial to the economy if they are transparent, clear, and serve financial inclusion goals. The crucial aspect is regulating the relationship between parties involved in economic transactions, which has been addressed through the recent legal frameworks and regulatory measures adopted by the Central Bank.